CSIP: PRELIMS BOOSTER SERIES-344 ENVIRONMENT AND ECOLOGY

CARBON BORDER ADJUSTMENT MECHANISM (CBAM)

Why in news: commerce minister Piyush Ghoyal said the India will retaliate against any discriminatory tax practices like CBAM during press conference

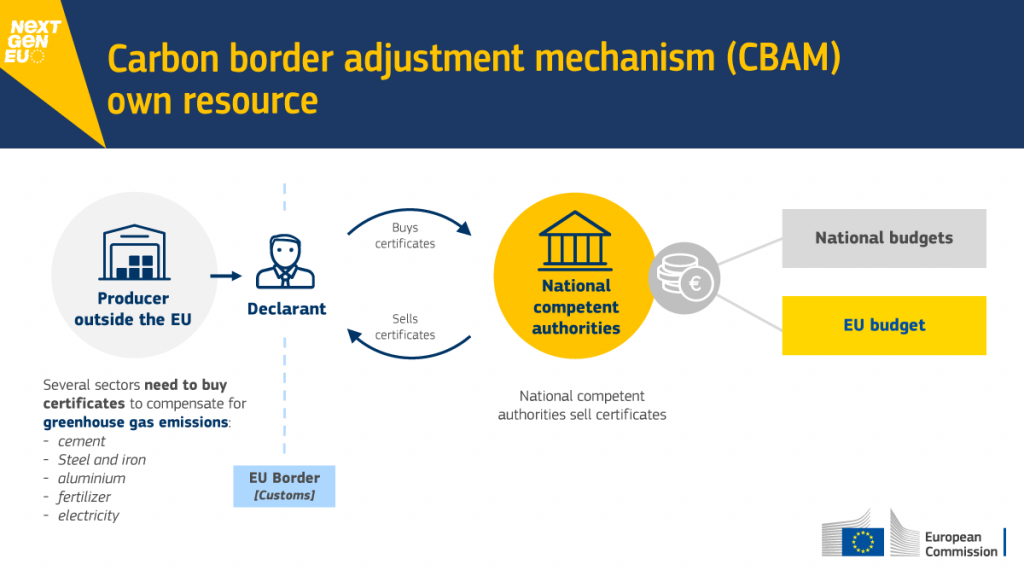

The European Union (EU) agreed on a preliminary deal for an EU Carbon Border Adjustment Mechanism (CBAM) on imported goods such as iron and steel, cement, aluminium, fertilisers, electricity and hydrogen.

The CBAM/ a carbon border tax/ carbon leakage instrument was proposed by the EU in 2021 and will be applicable from October 1, 2023.

Background: According to the standard economic theory of trade, imposing carbon taxes on domestic producers without an adjustment mechanism would certainly cause a shift of production to places where those taxes can be avoided.

About Carbon Border Tax:

A carbon border tax is an import duty based on the amount of carbon emissions produced by the goods in question.

It discourages emissions as a carbon price, and it has an impact on production and exports as a trade-related measure.

Stated goal of CBAM:

To eliminate the difference in carbon price paid by company’s subject to the EU’s Emissions Trading System (ETS) and the price paid by companies elsewhere.

Levelling the playing field for EU firms.

To implement stronger emission reduction efforts.

Incentivises non-EU countries to increase their climate ambition.

It will ensure that EU and global climate efforts are not undermined due to the relocation of production which is defined as ‘carbon leakage’.

Concerns:

From an equity perspective, it increases costs in poorer countries, due to the need to remit new taxes, etc.

Such schemes are still rare in most of the world and introducing them will be a major policy challenge for lower-income countries.

For countries reliant on one of the targeted industries – like Mozambique’s aluminium extraction, this could be a major economic shock.

If enacted unilaterally, it is likely to unfairly protect domestic industries from international competition – a practice known as ‘green protectionism.’

BASIC countries have emphasised that carbon border taxes could promote market distortion and worsen the trust deficit among countries.

Way ahead: Coordinated application of carbon taxes and related climate change avoidance measures would make it unnecessary to apply a border adjustment mechanism.