CSIP: PRELIMS BOOSTER SERIES – 250 INDIAN ECONOMY

INSURANCE SURETY BOND

- NHAI (National Highways Authority of India) adopts innovative approach for Toll Operate Transfer (TOT) projects in the road infrastructure sector.

- Replaces Traditional Bank Guarantees with Insurance Surety Bonds to boost liquidity and encourage private participation.

- NHAI collaborates with insurance companies to issue over 40 such bonds for various contracts, indicating widespread acceptance.

- Ministry of Finance, Government of India, recognizes equivalence of e-BGs and Insurance Surety Bonds with Bank Guarantees in government procurements.

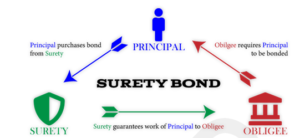

- Surety bonds, a form of unique insurance, ensure compliance, payment, or performance of obligations.

- Three-party agreement: Principal (debtor), Surety (third party), and the obligation for payment if the principal fails.

- Surety bonds act as a financial guarantee, with the principal retaining primary liability and the surety assuming secondary liability.

Transformative shift in the road infrastructure landscape, promoting the ‘Ease of Doing Business’ and facilitating seamless development.